Builder Collapse Sparks Legal Battle for ACT Buyers

A dispute between buyers and the owners corporation of an ACT development has exposed the challenges facing buyers of projects where builders have collapsed.

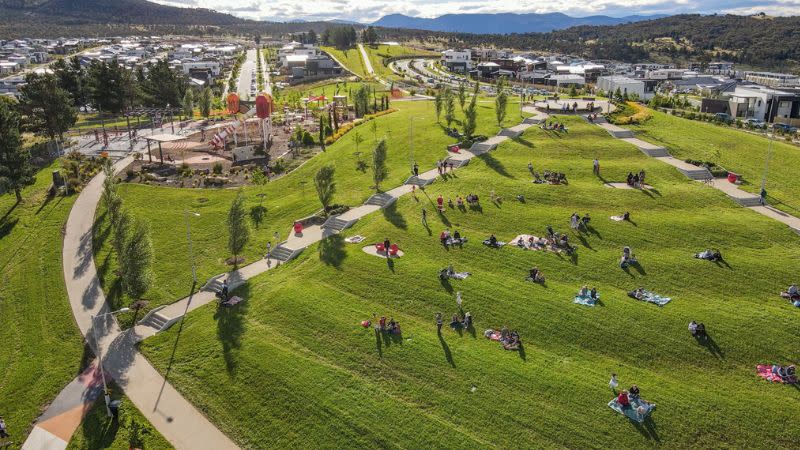

The fallout from a legal claim to fund the rectification of building defects at the Denman Prospect suburb comes as Equifax released its latest report on builder reputations.

The credit reporting agency, which administers the independent construction industry rating iCIRT, found nine in 10 consumers were concerned builders would cut corners to reduce costs and deliver homes faster.

The owners of 53 units at an unnamed mixed-use development in the suburb 13km west of Canberra took its corporation to the ACT Civil and Administrative Tribunal over fund contributions to rectify building defects at the site.

The homes, at unit plan 15667 and described in real estate listings as being a development on Bamblett Rise, were built in two stages by separate builders—the townhouses were constructed as stage one and an occupation certificate was issued in 2022.

The apartments in buildings 3 and 4 were built as stage two, which was issued with an occupation certificate in February 2023.

It was agreed at a meeting that a general fund contribution would be paid into the administrative fund of the corporation based on its proportion of unit entitlement.

The meeting was also the first time it became apparent building defects would become more of a problem.

Owners asked when building defects from stage one would be fixed and requested an engineer’s report.

But in October 2024, the unnamed builder of stage two went into administration. Insurance was in place for internal apartment defects.

But the builders’ warranty insurance was “unlikely to cover defects in apartment-only common areas”.

This was a problem due to the volume and severity of stage two building defects that apartment owners were discovering. As well, an engineer was instructed to inspect townhouse balconies, which were within the responsibility of the owners corporation.

The owners corporation agreed to engage a law firm to prepare and lodge a claim against the stage two builders’ warranty insurance, considered urgent due to a 90-day deadline to submit the claim, with a split budget proposed to cover the costs.

This included a special levy payable by apartment owners to cover the legal costs of the claim.

In December 2024, engineers reported “multiple, systemic and recurring defects” in apartments, apartment-specific common rooms and defects to townhouse balconies and roofs.

The tribunal ruled that the opposition to the split budget proposed was “not unreasonable” and dismissed the application to enforce it.

The issue has highlighted the ongoing problems for buyers of off-the-plan units, especially when builders enter administration.

Equifax, which oversees iCIRT ratings, found that 78 per cent of Australians are concerned about construction insolvencies, and half have “little or no confidence” in the quality and long-term durability of new apartment buildings.

While to date iCIRT has been predominantly taken up in NSW—and nearly half of NSW financiers use the rating as part of their due diligence according to Stamford Capital—iCIRT is a “national solution”, Equifax said.

Assessments can be conducted on construction industry businesses no matter where they are, it said.

Equifax told The Urban Developer that it was “actively engaging with state governments to help encourage higher levels of consumer and buyer confidence from construction industry players”.

In July this year it became the approved provider of ratings to support the Property Development Act in the ACT.