Demand for Australian Industrial Assets to Grow: Moody’s

E-commerce, tech innovation, and infrastructure spending is expected to bolster demand and investment in Australia’s industrial real estate sector.

The latest Moody's report says industrial assets are forecast to outperform the nation’s broader commercial property market across the next several years, largely thanks to accelerated growth in e-commerce activity and technological innovation.

“Creating a wider range of applications for industrial assets, making them more resilient than in previous property cycles,” the report notes.

Current demand for industrial space exceeds both supply and long-term demand averages, according to Moody's, with major metropolitan areas experiencing a shortage of available industrial zoned land, especially around key transport nodes.

The report identifies industrial markets, the major capital cities of Sydney, Melbourne and Brisbane, along the eastern seaboard as experiencing “elevated levels of demand” in the sector.

Related: Industrial Sector Braces for $21bn Capital Injection in 2019

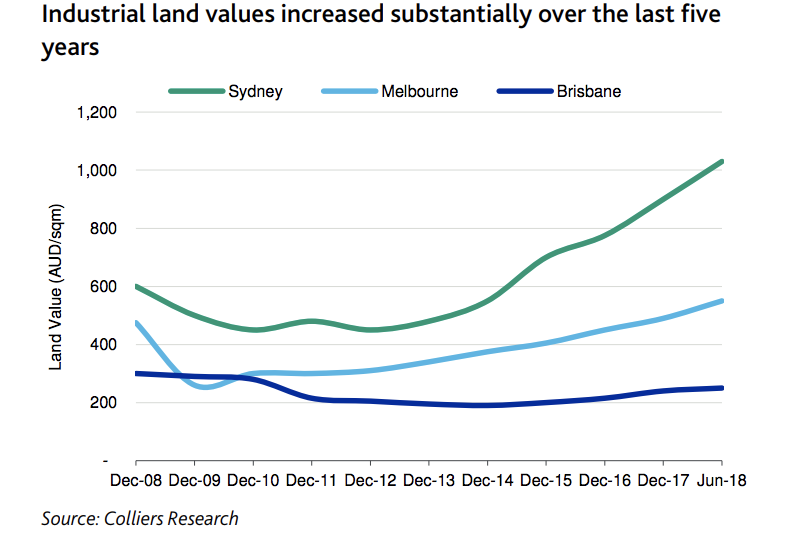

Subsequently, the demand for industrial assets have put upward pressure on land values.

Sydney values increased by around 50 per cent over the past three years, followed by Melbourne at 35 per cent and Brisbane recording a 25 per cent rise.

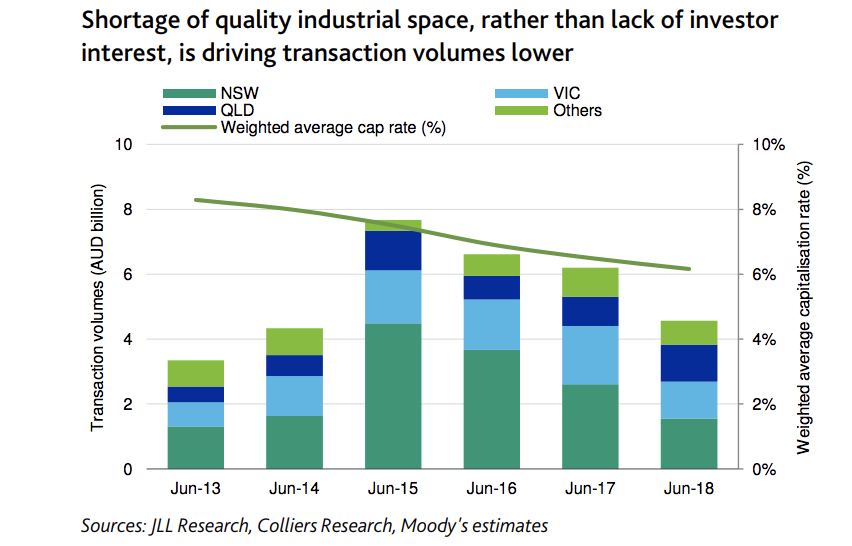

“We expect cap rates will likely compress further over the next 6-12 months, as rising rents support asset values,” Moody’s said.

Related: Sydney Among World's Most Expensive Industrial Markets

Identifying opportunities?

As large blocks of land become harder to secure in the Sydney area, Moody’s expects tenants to increasingly look for comparable and cheaper options in Melbourne and Brisbane, servicing Sydney out of these cities.

Online players

Demand for space is also expected to be driven by the expanding needs of heavyweights, and “online players”, such as Amazon.com and Alibaba Group.

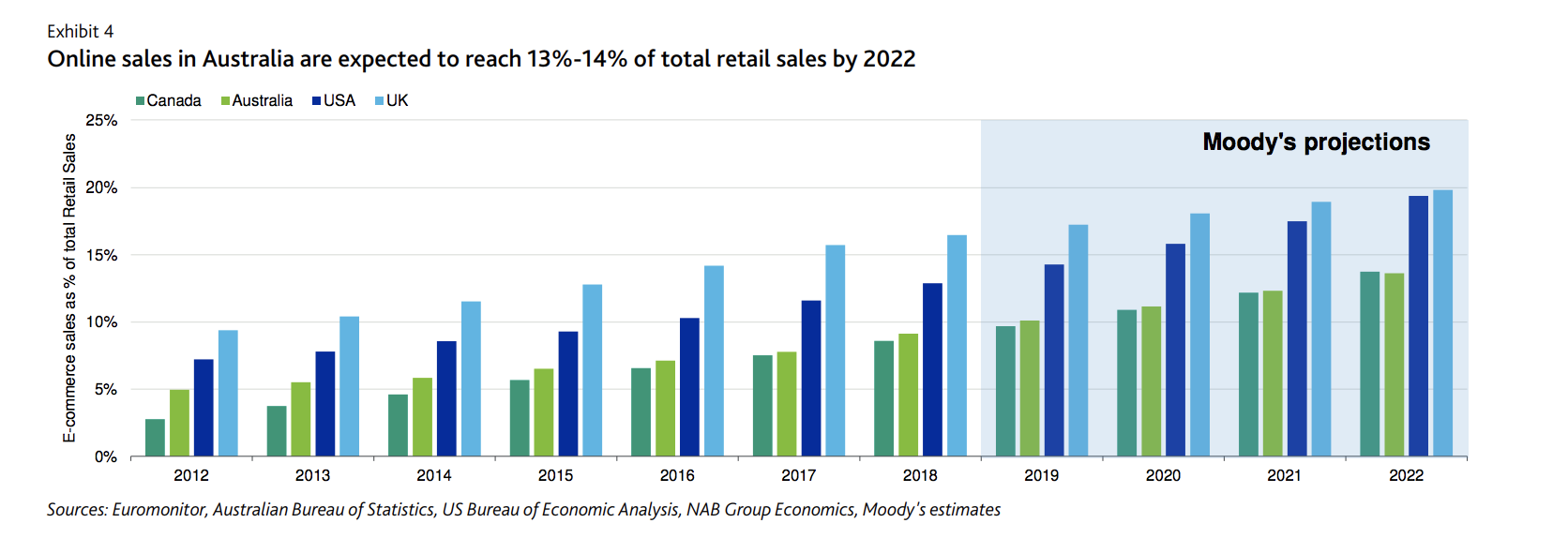

“We see large untapped potential for the e-commerce sector as the penetration rate in Australia lags those of other developed nations like the US and UK.”

“Online as a percentage of total sales in Australia was around nine per cent in 2018, which lags the US by around four years and the UK by seven years.

“The US and UK penetration rates are now around 13 per cent and 17 per cent, respectively.”

Related: Infrastructure Spending Set to Peak: Deloitte

While, large investment programs in public infrastructure that improve transport efficiency and connectivity are expected to drive valuation growth.

“The state governments of New South Wales, Queensland and Victoria plan to increase their respective infrastructure spending programs the most, although we believe the major benefits of this spending for industrial assets will be in the longer term,” Moody’s notes.

“This will be further supported by the Australian Government's commitment to spend more than $75 billion over the next 10 years on transport infrastructure across Australia under the National Infrastructure Plan.”