Resources

Newsletter

Stay up to date and with the latest news, projects, deals and features.

Subscribe

As rental affordability continues to deteriorate, tenants are starting to favour larger homes, according to new data.

According to CoreLogic’s newly launched bedroom count metric, a slight slowdown in net overseas migration may also be a driving factor slowing demand for smaller, inner-city units.

The metric analyses housing market performance segmented by the number of bedrooms and has revealed a slowdown in rental growth for homes with fewer bedrooms, CoreLogic head of research Eliza Owen said.

“For houses, rents increased 8.4 per cent nationally in the year to June, ranging from a 7.6 per cent rise in houses with up to two bedrooms, to 8.7 per cent in larger houses with five bedrooms or more,” Owen said.

“In the unit segment, which includes properties on strata titles such as townhouses and apartments, there has been an even more substantial slowdown in the rent growth of smaller homes.”

Annual growth in one bedroom units and studios slowed from 16.8 per cent in the year to April 2023 (a series high), to 7.1 per cent in the past 12 months.

“This was the weakest annual growth of unit rents by bedroom count in the period,” Owen said.

“Similarly, two-bedroom units have had a slowdown in annual rent growth from 15.4 per cent in the year to May 2023, to 7.9 per cent in the past 12 months.”

Despite the slowdown, two-bedroom units maintained the highest rent growth on a national level, the data found.

Since the onset of Covid, smaller units have had larger movements in rent value, Owen said.

“This is because almost a quarter of units with one or two bedrooms in Australia are located within inner-city regions of the three largest capitals, as defined by the SA4 markets of Melbourne ‘Inner’, Sydney ‘City and Inner South’ and Brisbane ‘Inner City’,” she said.

“Rental demand in these markets has been highly impacted by changes in overseas migration.

“As borders closed down, a disproportionately sharp drop in tenants from overseas (a primary source of inner-city rental demand) alongside job losses within the hospitality, tourism and the arts sectors caused a pronounced decline in inner city unit rents.

“When international arrivals resumed, it meant this stock outperformed.

“Since early 2023, net overseas migration has gradually been trending lower since historic highs, and annual rent growth seems to be following in units with one or two bedrooms and studios,” she said.

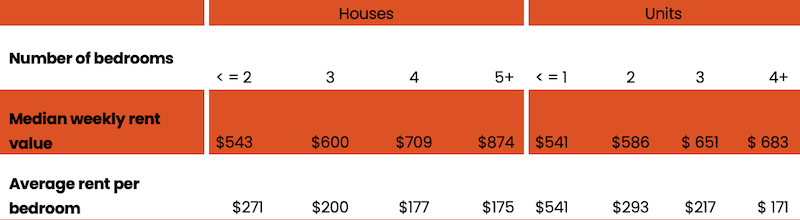

National median weekly rent value, June 2024, by bedroom

Larger rental properties were showing more resilient rent growth, despite being more expensive, the data showed.

“Large rental properties may actually be more feasible for renters in share situations, including reforming group households and multi-generational households,” Owen said.

“The graph (above) shows the current median weekly rent across Australia by bedroom, and divided by the bedroom count.

“At least for the national medians, the average rent for a bedroom (that is: total rent divided by number of bedrooms) is lower the higher the bedrooms are.

“At the time of the 2021 census, group households made up a relatively small portion of living arrangements, accounting for around 3.6 per cent of people in private homes.

“But with most rental leases in Australia being a relatively short 12 months, rising rent costs may prompt some renters to form share houses and seek out larger dwellings for a cheaper room rate.”

Owen said that as well, annual rent growth might be higher in larger homes now because it lagged earlier in the pandemic period.

“The RBA highlighted a trend of share houses breaking up and spreading out across the rental market through Covid, which may have driven popularity in smaller homes that offered fewer bedrooms and a home office through 2021.

“Two-bedroom units had the biggest growth in rents nationally since the start of the pandemic, as well as three-bedroom houses.”