NOMINATIONS CLOSE SEPTEMBER 12 RECOGNISING THE INDIVIDUALS BEHIND THE PROJECTS

NOMINATIONS CLOSING SEPTEMBER 12 URBAN LEADER AWARDS

Resources

Newsletter

Stay up to date and with the latest news, projects, deals and features.

Subscribe

The Australian rental market has experienced its slowest rent price growth in four years.

According to new data from CoreLogic, national rents rose a modest 0.1 per cent during July.

CoreLogic Australia economist Kaytlin Ezzy said the easing in the monthly growth trends marked a stark contrast to the 39.7 per cent surge in rents of the past five years.

Ezzy said the slowdown was a positive sign for renters, who have faced a significant increase in median weekly rental payments—up by about $180 over the past five years.

“July’s small rise in national rents signals a broader cooling trend across the country and will provide some renters a much-needed respite after years of high demand and steep increases,” she said.

Results were varied across the country with rents rising 0.6 per cent in Adelaide and 0.3 per cent in Melbourne and Perth, while remaining flat in Darwin and Canberra.

Meanwhile, rents have declined in Sydney (-0.1 per cent), Brisbane (-0.1 per cent), and Hobart (-0.3 per cent).

“The varied rental growth across capitals highlights an affordability ceiling in major cities,” Ezzy said.

“With tenants unable to borrow more to cover rent, many are turning to alternatives such as shared housing, relocation to more affordable areas, or leaving the rental market altogether and buying their own homes.”

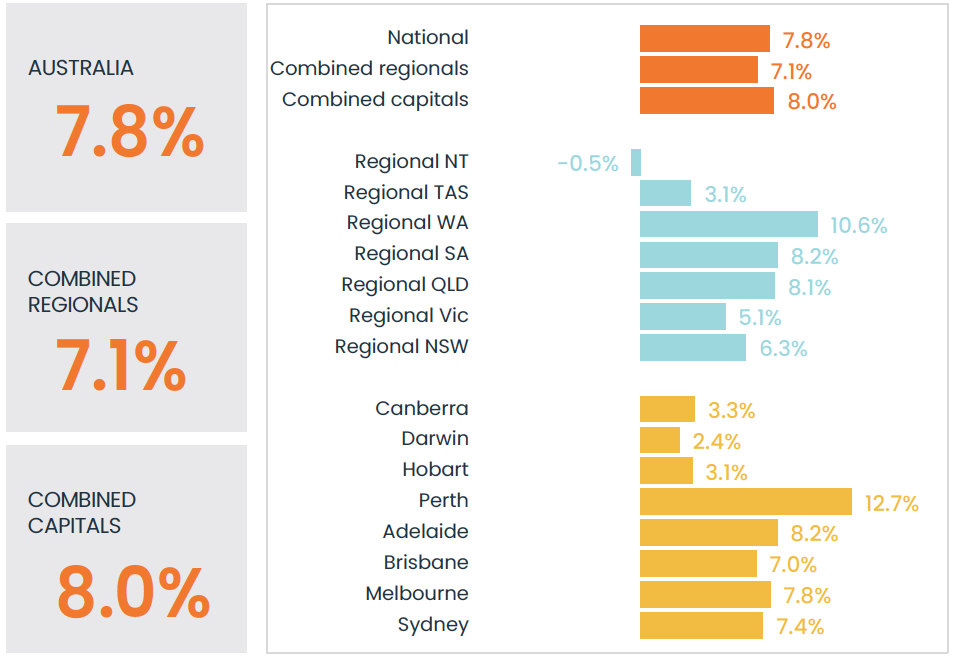

From an annual perspective, CoreLogic said its Rental Value Index had recorded the smallest 12-month change in three years, with national rents up 7.8 per cent in the year to July, down from a recent peak of 8.6 per cent in April.

This slowdown was largely driven by a reduction in growth rates in the capitals, from 9.7 per cent in February to 8 per cent in July, while regional areas’ growth accelerated from 5.4 per cent to 7.1 per cent over the same period, CoreLogic said.

Perth recorded the strongest rental growth, with annual rents increasing by 12.7 per cent followed by Regional WA at 10.6 per cent.

“Regional areas are benefiting from lifestyle changes, relative affordability, and migration trends,” Ezzy said.

“The high cost of renting is also likely to be motivating more people with the financial means to service mortgage repayment and job security to buy their first home, and we’re also seeing investors take notice too.”

Despite an easing in net overseas migrations and a deceleration in rental growth, substantial relief for the rental market seemed unlikely in the short term, Ezzy said.

“Low supply will likely continue to put upward pressure on rents, albeit at a slower pace,” she said.

“With dwelling approvals and commencements at historic lows, providing sufficient new housing will not be a quick fix and remains a genuine challenge for policymakers, the property industry and of course tenants.”