Resources

Newsletter

Stay up to date and with the latest news, projects, deals and features.

Subscribe

Australian construction is at a pivotal point with decade highs in the value of work yet to be done, commencements, and projects under construction, according to international quantity surveyor Rider Levett Bucknall.

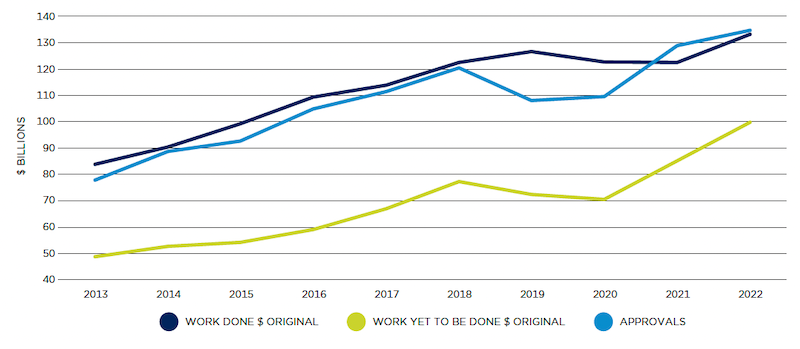

According to the RLB Third Quarter 2022 Australia Report, one of the key metrics measured in the report, work yet to be done, an indication of building work yet to have been completed within the industry, had risen rapidly during the past five quarters.

The value of work yet to be done within the industry is at record highs—it was $187 billion as at March 31 2022, up about 39 per cent from December 2020 and has now risen by $41 billion in the 12 months to $228 billlion.

“This adds pressure on the already stretched workforce to complete the current undertakings and to provide sufficient resources to new projects commencing,” RLB R&D director, Oceania, Domenic Schiafone said.

“With already significant levels of work not being completed, the industry’s current and future capacity to deliver projects on time, on budget and on specification is fundamental for all property development decisions, but these principles are now under stress.”

Multi-level apartment approvals and commencements across the country lifted during 2021 with a “very welcome” 20 per cent increase in approval volumes and 16 per cent in home numbers.

Commencement values were down, however, with a further drop in 2021 of 4 per cent. Houses, on the other hand, had a 3 per cent rise in commencement values.

According to the report, approvals in the first six months of 2022 have cooled from the levels achieved in 2021—total approvals fell by 5 per cent for the first six months of 2022 compared to the same period of 2021.

Residential approvals fell by 9.5 per cent but non-residential approvals rose by 1.1 per cent due to high levels of government spending in education (up $1 billion) and health (up $1.5 billion).

The current value of work yet to be done will ensure that volumes of work done during 2022 and 2023 should not fall backwards if these approvals break ground,” Schiafone said.

Building work yet to be done vs work done, $ original

“Given the significant rise in both commencements and work yet to be done for 2022 across the country, strong activity should be seen in 2023,” he said.

“Looking forward into the later stages of 2022 and into 2023, we should see the pressure points in supply chains starting to ease as global demands softens with inflationary pressures in all main economies curtailing demand.

“This easing of demand should allow manufacturing and logistics to get back to “normality”.

“It should also mean a softening of material prices with the high levels of ‘demand-led price premiums’ reducing.”

The report highlights the extreme pressure and volatility on contractor tender pricing, which, it said, will continue across Australia.

“Factors that influenced pricing in 2021 have remained prevalent and pressure increased in the first half of 2022 and is predicted to continue into 2023,” Schiafone said.

Head contractors have reported volatile pricing from the subcontract market, difficulty in pinning down pricing, and sub-contractors being selective in committing to tenders, as many are at capacity or unable to secure the appropriate levels of labour.