Challenging Conditions in the Major Apartment Markets

Conditions remain tough for developers in kicking off new projects, with slow pre-sales rates making it harder to reach high financier pre-sales hurdles, particularly for larger development projects.

JLL’s state residential apartment market report shows there were 40,800 apartments under construction at the end of the fourth quarter last year, this figure down from 44,300 at the end of the third quarter for 2018.

Australian head of residential research for JLL Leigh Warner anticipates the challenging conditions in Australia’s largest apartment markets to linger over at least the first half of 2019.

“The bottom line is that it will remain very difficult to get new projects started for quite some time yet and there is even a risk that supply will fall too sharply,” Warner said.

Latest ABS building figures show apartment approvals declined by 18.8 per cent in December, following an 18.3 per cent drop in November.

But there is an upside. Warner says supply has peaked and it is expected to fall sharply this year.

“While underlying demand growth is still strong due to robust population growth, this will help re-establish equilibrium relatively quickly in our view,” Warner said.

“Further, the affordability of apartments relative to detached housing will provide some support to demand as younger buyers look to take the opportunity of a slower market to enter.”

Sydney

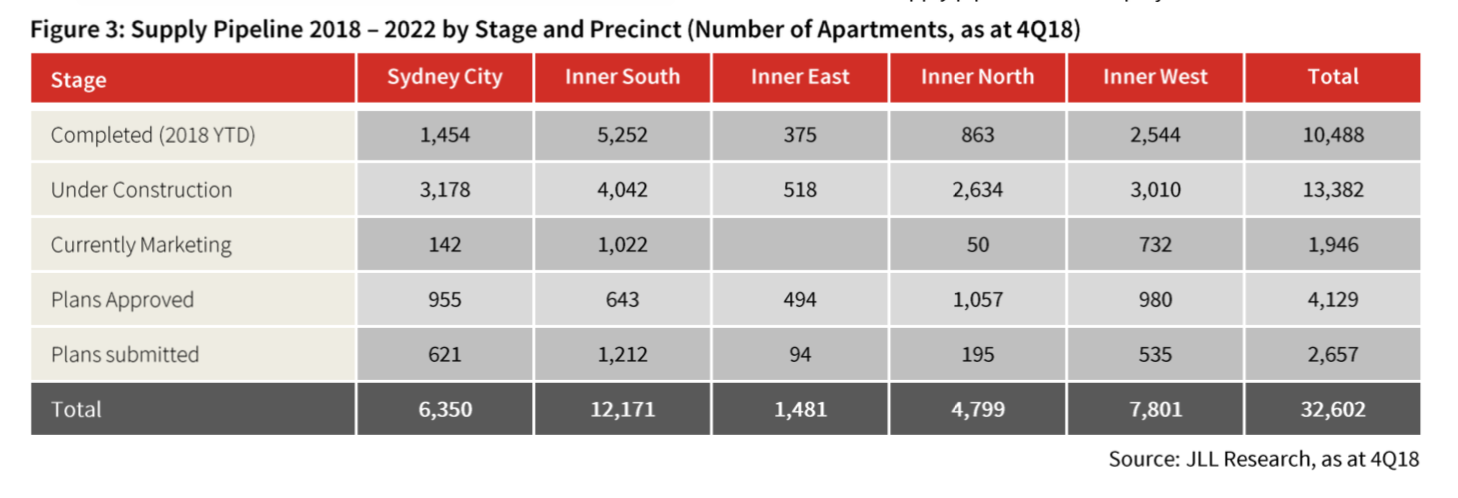

Inner Sydney’s apartment construction cycle peaked in 2018 following strong completions of 2986 apartments in the fourth quarter of 2018.

The report shows total apartment completions reached 10,488 units for the year.

“Following the peak, Sydney’s apartment supply pipeline will drop by approximately 40 per cent in 2019, down to 2017 levels, assuming there are no significant delays.”

Looking ahead the report notes the supply line is subdued with approximately 3500 - 4500 units per annum expected between 2020-to-2022.

“Sydney City is expected to experience less residential development activity going forward, particularly in the CBD area. This is in part due to pre-sale hurdles becoming more difficult to achieve in the area as investor demand has fallen sharply,” the report notes.

“Focus is, therefore, shifting to smaller projects in inner suburbs that are attractive.”

While the outlook for 2019 appears to remain a falling market, JLL expects conditions to stabilise and “head towards recovery by year-end”.

Melbourne

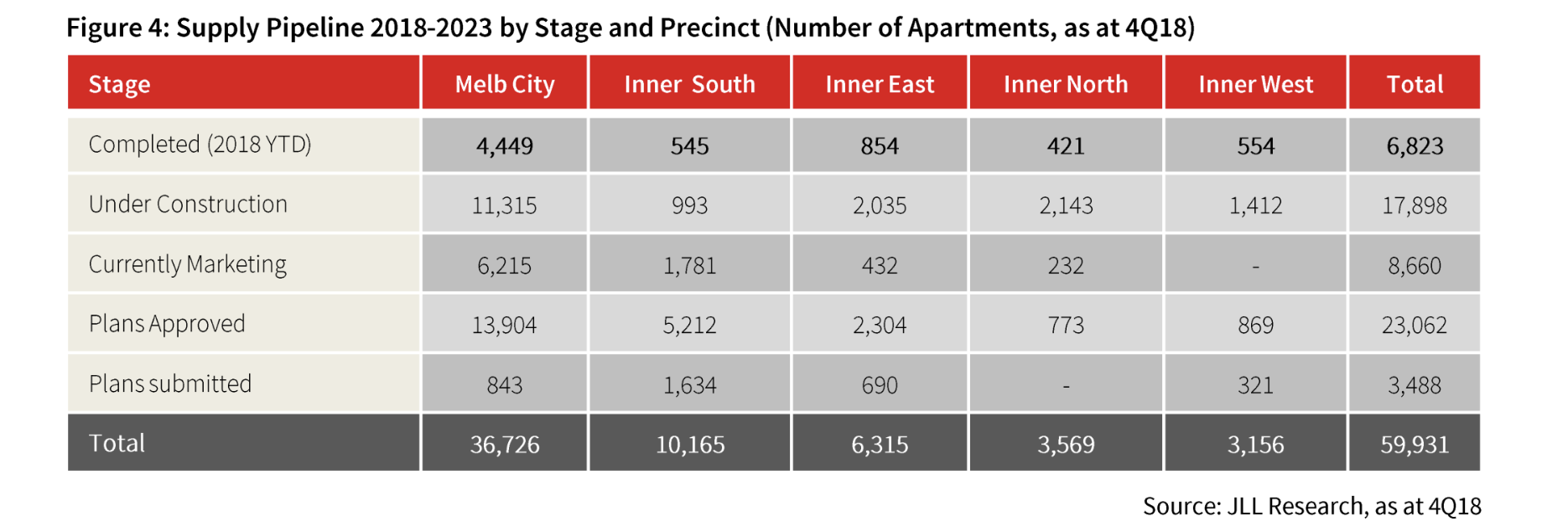

In the fourth quarter of last year, 17,900 apartments were under construction, concentrated in the Melbourne City precinct.

“There were 6820 apartments completed during 2018, 41 per cent below the peak of annual completions in 2017. Annual completions are likely to further decline in 2019.”

Victoria’s economic conditions have remained solid despite the residential market slowdown.

“A strong pipeline of infrastructure projects and commercial development will somewhat support the construction sector as residential supply falls.

“Population growth will continue to support underlying dwelling demand and will protect rental values and prices to a certain extent.”

The report anticipates a further cooling in apartment prices in 2019.

“There is a strong pipeline of approved apartment projects in inner Melbourne, many projects will not proceed as pre-sales and subsequent development funding remain difficult to obtain.

“While a current disparity exists between vendors and purchasers of development sites, developers that cannot afford to hold projects are likely to offload projects at a discount.”

Related: Banking Royal Commission: What Does It Mean For The Housing Market?

Across the areas monitored in the five major capital city markets, the JLL supply data suggests around 23,200 apartments were completed in 2018.

“And this is likely to fall by around 31 per cent to around 16,000 in 2019,” the report notes.

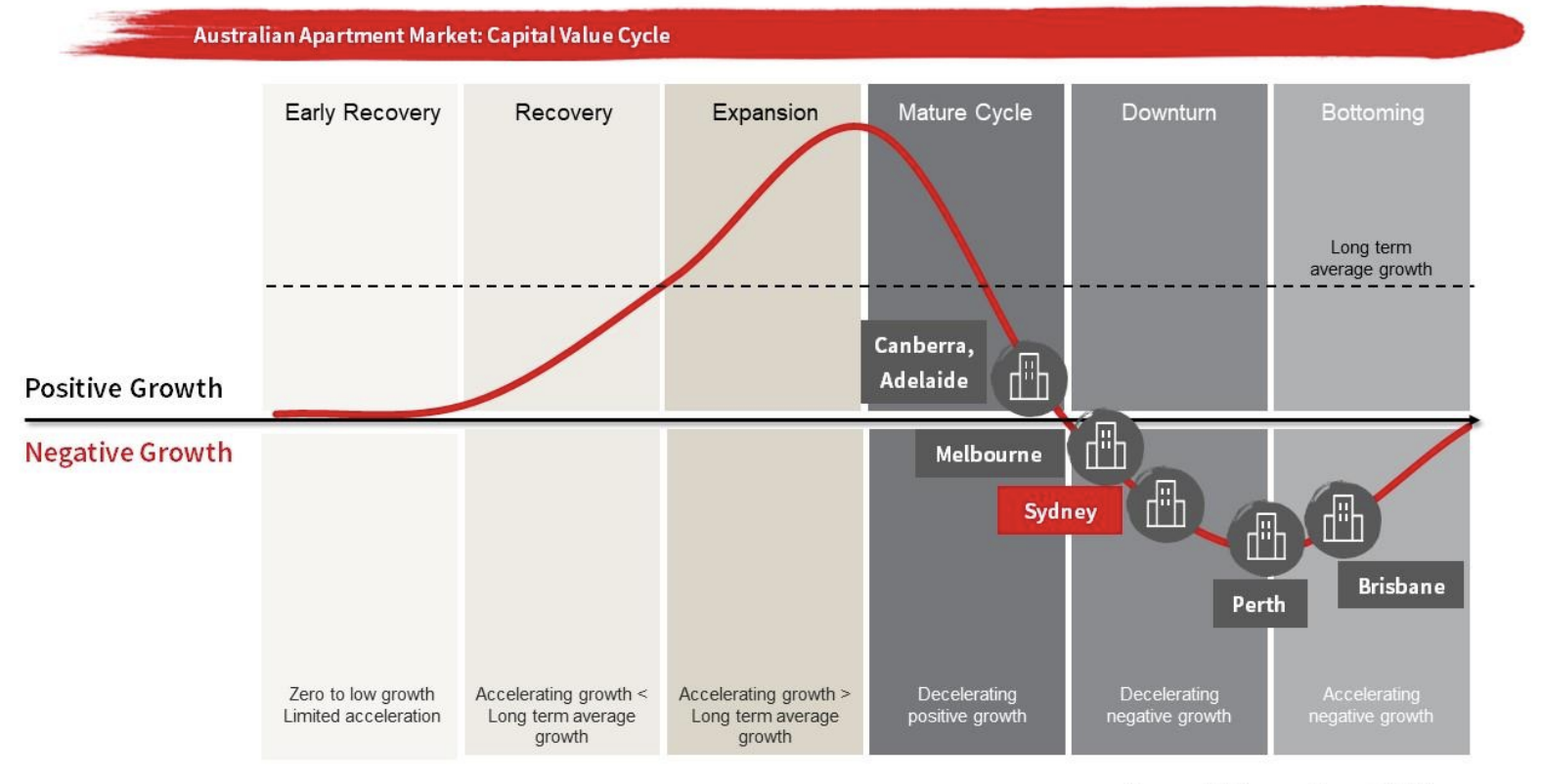

Warner says Perth’s weak rental market is now improving, but prices are still declining, while Brisbane apartment prices appear to be stabilising.

“In contrast, Adelaide and Canberra are behind in the cycle and are slowing after a relatively strong run,” Warner said.

“Nevertheless, we don’t expect declines of the magnitude of Sydney and Melbourne in these markets because they simply have not seen anywhere near the same run-up in prices over the past five years.”