Australia’s Hotel Sector Rides New Wave of Success

Exceptional levels of domestic tourism, international arrivals climbing, an Asia-Pacific expansion by a major US carrier, record Easter travel, and rising average daily room rates ... it seems there’s no end to the good news for Australian hotels.

And while CBRE’s head of hotels Ally McDade cautions of the headwinds of construction costs and the cross winds of inflation, there seems little doubt the sector is in good shape and likely to get better, at least in the short term.

“I think it’s important that we don’t forget that Australia’s really a bucket-list destination, and there’s usually a 12-to-18-month window from where people plan a trip to actually making a booking,” McDade said.

“So in essence, it’s our view that we should see a marked improvement in those rates over the next six to 12 months.”

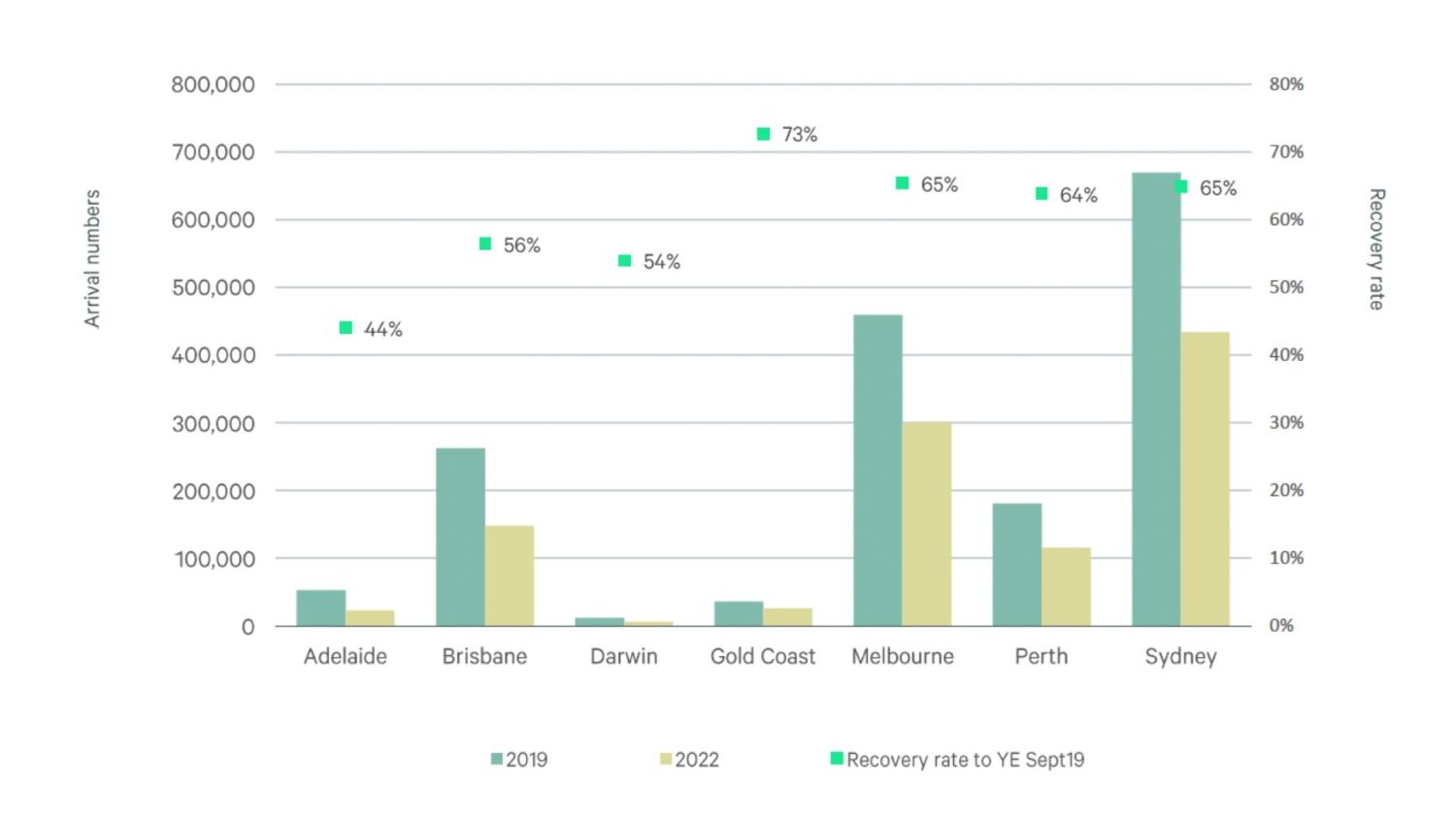

Speaking at The Urban Developer’s Hotel Development vSummit, McDade told participants the Gold Coast was the fastest-recovering destination market, back to 73 per cent of what its international passenger arrival rates were in 2019, albeit, on low volume.

Australia’s two major gateway cities—Sydney and Melbourne—are sitting at about 65 per cent what they were in 2019.

Who’s returning to Australia?

Indians, says the CBRE researcher.

“In the last quarter, India started at about 50 per cent of what they were in 2019, and that has actually gained to 80 per cent. That’s just over the last quarter,” McDade said.

“So they now represent Australia’s fastest-recovering market and their total spend and nights stayed (rate) is also up about 90 per cent.”

The vSummit was told the Department of Foreign Affairs and Trade reported that by 2035 Indian tourism was expected to grow four-fold to more than 1.2 million people. That would inject about $9 billion into Australia’s economy.

The country’s traditional tourism markets of the UK and the US had not recovered as fast, now sitting at about 40 per cent of their 2019 levels.

But McDade pointed to an announcement last week by United Airlines that it was adding 40 per cent more services from the US to Australia and New Zealand.

“There’ll be about 66 flights from the US to Australia per week,” she said. “And that’s actually the largest South Pacific expansion plan in history.

“And what we should start to see from that is record-high flight pricing will decrease and encourage people who have been thinking about booking that trip to actually start actively taking it.”

International airline passenger arrivals, September 2019 v. September 2022

CBRE’s data shows Average Daily Rates (ADR)—a key hotel performance indicator—grew a record 23 per cent in the past 12 months, up 26 per cent on 2019 rates. And that has made the sector something of a hedge against inflation.

“Because hotels have an ability to set a daily rate as opposed to a lot of other property sectors, it has allowed them to hedge against inflationary pressures,” she said.

This was especially true of the burgeoning boutique hotel trade, McDade said.

“It’s a segment that has the most promise as an inflation hedge, due to the fact that the clientele is less price sensitive. And that should cushion against external or economic impacts.”

The global real estate services giant is tracking 7500 hotel rooms under construction across Australia. All have a completion date or 2023 or 2024.

“Sixty-five per cent of that is luxury or upscale stock which is an unprecedented level for Australia. And 40 per cent of that will actually land in Melbourne.

“I guess the upside of a lot of this supply coming online, is that it’s really setting a new luxury benchmark, and that will continue to elevate ADR, particularly within this class.”

McDade warns the development pipeline is likely to be constrained by construction costs, feasibility and overall debt costs.

“And once this sort of level of supply lands over the next two years, there will be a pause for breath.”