Investor Home Loan Values Surge 21pc

New housing loans to investors rose in February as values surged on the same period last year.

According to data from the Australian Bureau of Statistics (ABS), investor loans rose 1.2 per cent for the month while the value of new investor loans in February was 21.5 per cent higher than a year ago

ABS head of finance statistics Mish Tan said these loans made up more than half of the growth in total new loan commitments for the past year.

The value of new owner-occupier loans in March was 9.1 per cent higher compared to a year ago, while the value of owner-occupier first home buyer loans was 20.7 per cent higher over the same period.

The total number of new owner-occupier loans rose 0.9 per cent in February.

The number of owner-occupier first home buyer loans rose 4.3 per cent and were 13.2 per cent higher compared with a year ago.

The value of new loan commitments for total fixed-term personal finance fell 0.9 per cent to $2.4 billion. This was driven by a fall of 2.7 per cent in lending for the purchase of road vehicles.

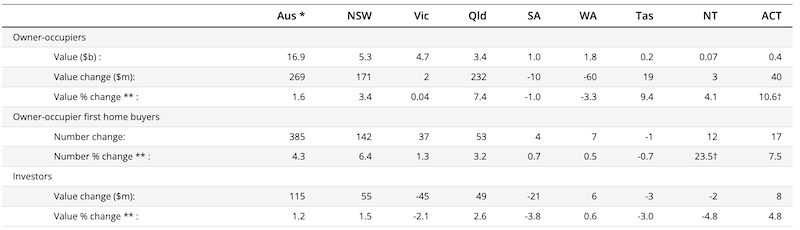

Housing finance loan commitments by property, purpose and state Seasonally adjusted, February 2024

Meanwhile, for the third time this year, all 36 experts surveyed for the Finder RBA Cash Rate Survey agreed the cash rate will stay where it is this month.

The survey found unanimous agreement that the RBA will once again hold the rate at 4.35 per cent when it makes its May announcement next week.

Finder head of consumer research Graham Cooke said hope of a near-term rate cut was quickly fading.

“Promising signs of inflation starting to ease were dampened by higher than expected figures from the March quarter,” Cooke said.

“The inflation rate is the one number the RBA is most influenced by, so it’s unlikely we’ll see a rate cut until at least December, if not later.”