UPCOMING EVENT - LAND LEASE DEVELOPMENT SUMMIT 10 DAYS TO GO

10 DAYS TO GO - LAND LEASE DEVELOPMENT SUMMIT

Resources

Newsletter

Stay up to date and with the latest news, projects, deals and features.

Subscribe

Home values in Australia rose in the June quarter, up by $225.9 billion, according to fresh data.

The preliminary estimate of the total value of residential homes in the quarter was $10,911.8 billion, up on the $10,685.9 billion of the March quarter, according to the ABS.

Of the total value of residential homes, $10,483.3 billion was owned by households.

The total value of residential homes rose in all states and territories, excluding Victoria.

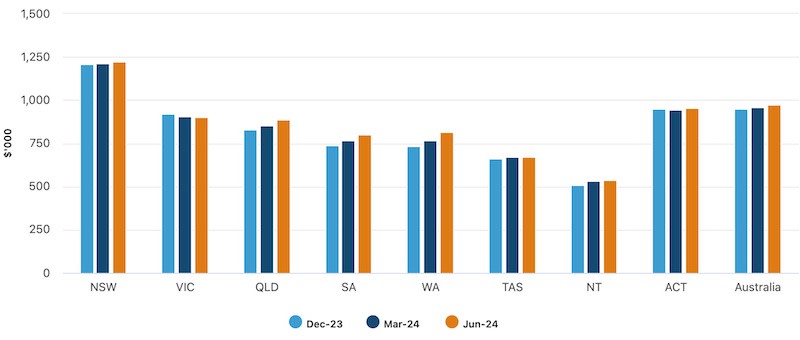

The number of residential homes in Australia rose by 52,900 to 11,211,000, while the mean price of residential homes rose by $15,600 to $973,300.

The mean price of residential dwellings in NSW ($1,222,000) remains the highest in the country, followed by the ACT ($953,900) and Victoria ($900,300). The lowest mean price is in the Northern Territory ($538,000).

Meanwhile, CoreLogic said an analysis of values over the three months to August found almost 30 per cent of the 3655 suburbs it looked at had recorded declines.

It said Melbourne suburbs (79.1 per cent) and regional Victorian suburbs (73.8 per cent) made up the majority of falls for the quarter.

Values also decreased across more than half of the suburbs in Hobart (54.3 per cent), Darwin (51.2 per cent), and Canberra (51.6 per cent), while all suburbs in Perth had values rise over the quarter.

CoreLogic Economist Kaytlin Ezzy said quarterly value declines were becoming more common as high interest rates, cost of living and affordability challenges continued to bite.

“While values are still rising at the national level, albeit at a slowing pace, beneath the headline figure, we’re starting to see some weakness, particularly in Victoria,” Ezzy said.

“In Melbourne, declines were most concentrated in more affluent regions, with 100 per cent of suburbs in the Mornington Peninsula recording decreasing values, while just one suburb in the Inner-South (Carrum) and three suburbs in the Inner-East (Box Hill, Deepdene, Canterbury) saw values rise over the quarter.”

Ezzy said that this fresh view of the data highlighted a creeping weakness in demand, and the variation in market conditions.

“Nationally the portion of suburbs in quarterly decline was 29.2 per cent in August, which has risen from 17.2 per cent a year ago.

“Behind Melbourne, Sydney has seen the biggest increase in the share of suburbs in decline over the past year, from 3.8 per cent to 25.9 per cent.”

She said WA was at the other end of the scale. Of the 146 suburbs analysed across regional WA, 127 recorded a quarterly rise in homes values, while all 302 Perth suburbs had values rise.

“This data shows a remarkable turnaround in the Perth market. In the three months to September 2022, 60.1 per cent of Perth suburbs were in decline. In the three months to August 2024, there was not a single suburb analysed where prices had fallen,” Ezzy said.