Gen Y is Earning More but Buying Houses Less

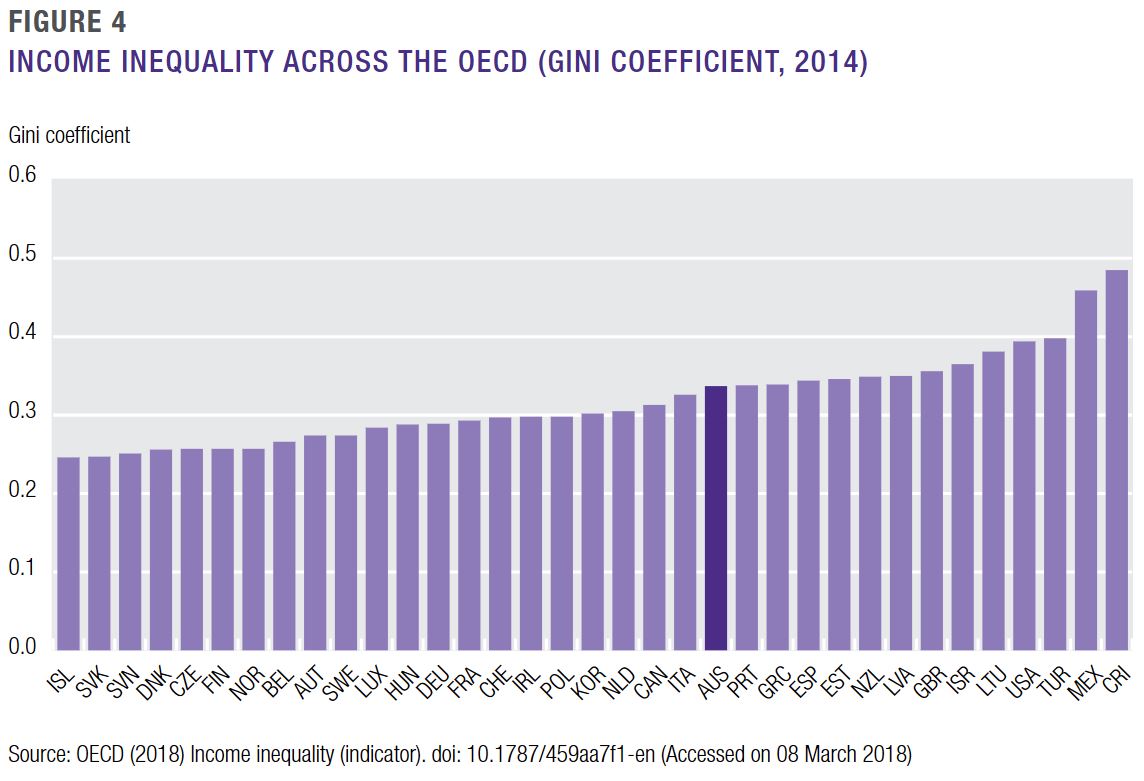

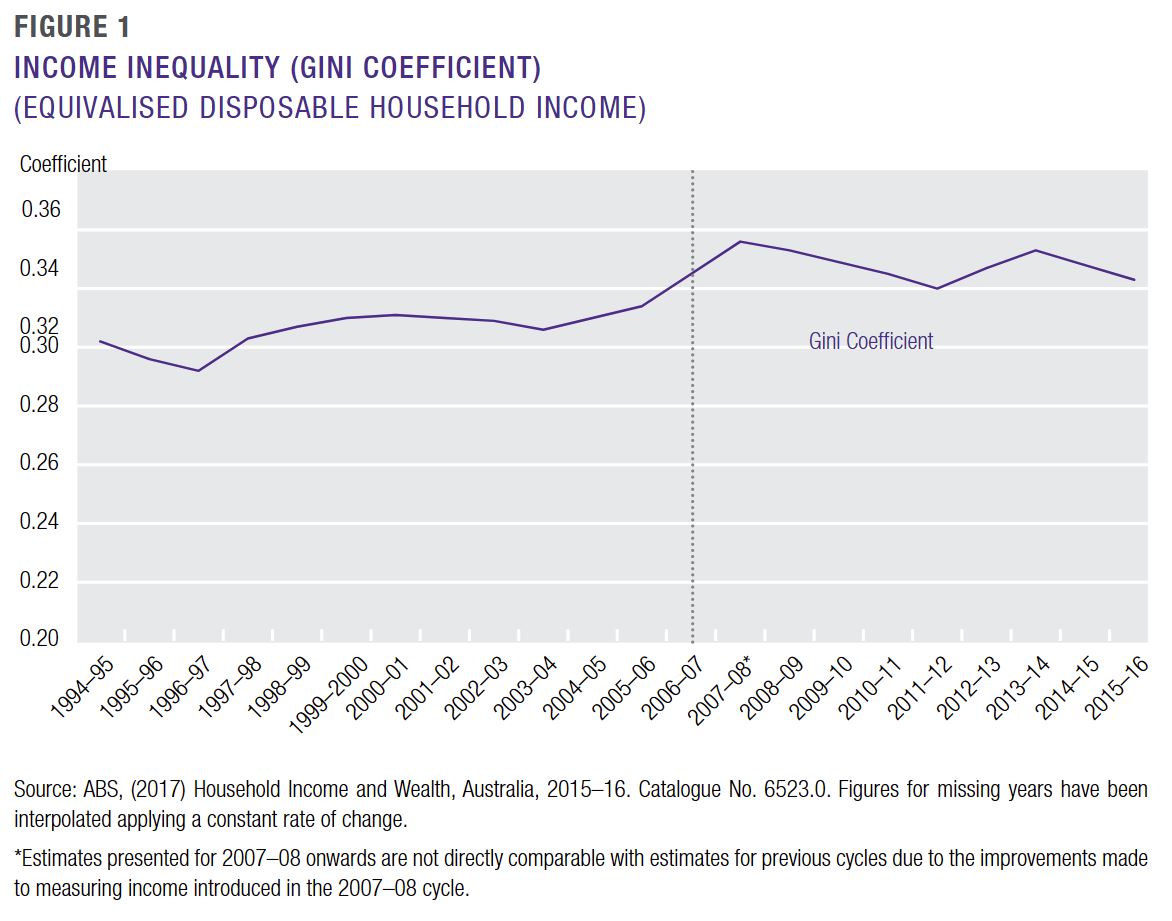

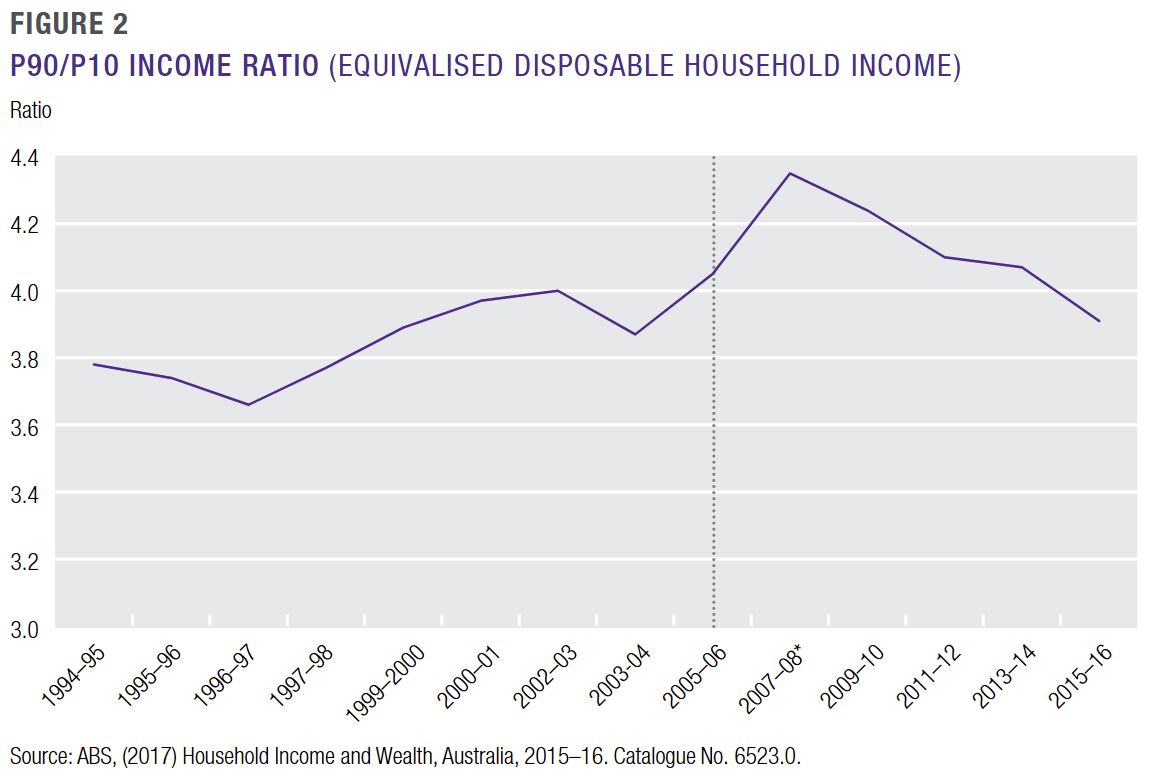

Inequality in Australia is the worst it’s been in two decades, with an ever-growing gulf between the rich and poor as the average wages of ordinary Australians are barely keeping up with inflation.

Bucking the trend is generation Y who have, according to a new report, experienced record income growth when compared to their international counterparts.

While generation Y has experienced income growth, their capacity to enter the property market remains to be seen as older generations are the beneficiaries of property and superannuation wealth, according to the Committee for the Economic Development of Australia’s “How unequal? Insights on inequality”.

The report, which offers seven recommendations to reduce inequality in Australia, suggests that to improve housing affordability the government should tax “a larger component of capital gains” and move towards charging an annual land tax in place of transaction taxes on housing such as stamp duty, and relaxing planning restrictions to allow increased housing density.

In Australia, younger households aged 25 to 29 experienced household income growth 27 per cent higher than the national average.

Professor Peter Whiteford from the Australian National University said that younger Australian households have continued to enjoy increases in real incomes over time, bucking trends for the same cohort internationally.

“Younger households have seen both declining rates of home purchasing and higher overall indebtedness associated with housing,” Whiteford said.

While older generations’ wealth in Australia has increased much more rapidly than that of younger generations, “due to both increasing superannuation wealth and increasing property wealth,” Whiteford said.

Workforce inequalities

Professor Alison Sheridan said Australia’s gender pay gap is around 15 per cent, with little change in the last two decades.

“While the gender pay gap has been an enduring feature of the Australian labour market, it gained more attention in 2017 as the abstract statistics came to life through high profile cases of women in media being paid significantly less than their male counterparts.”

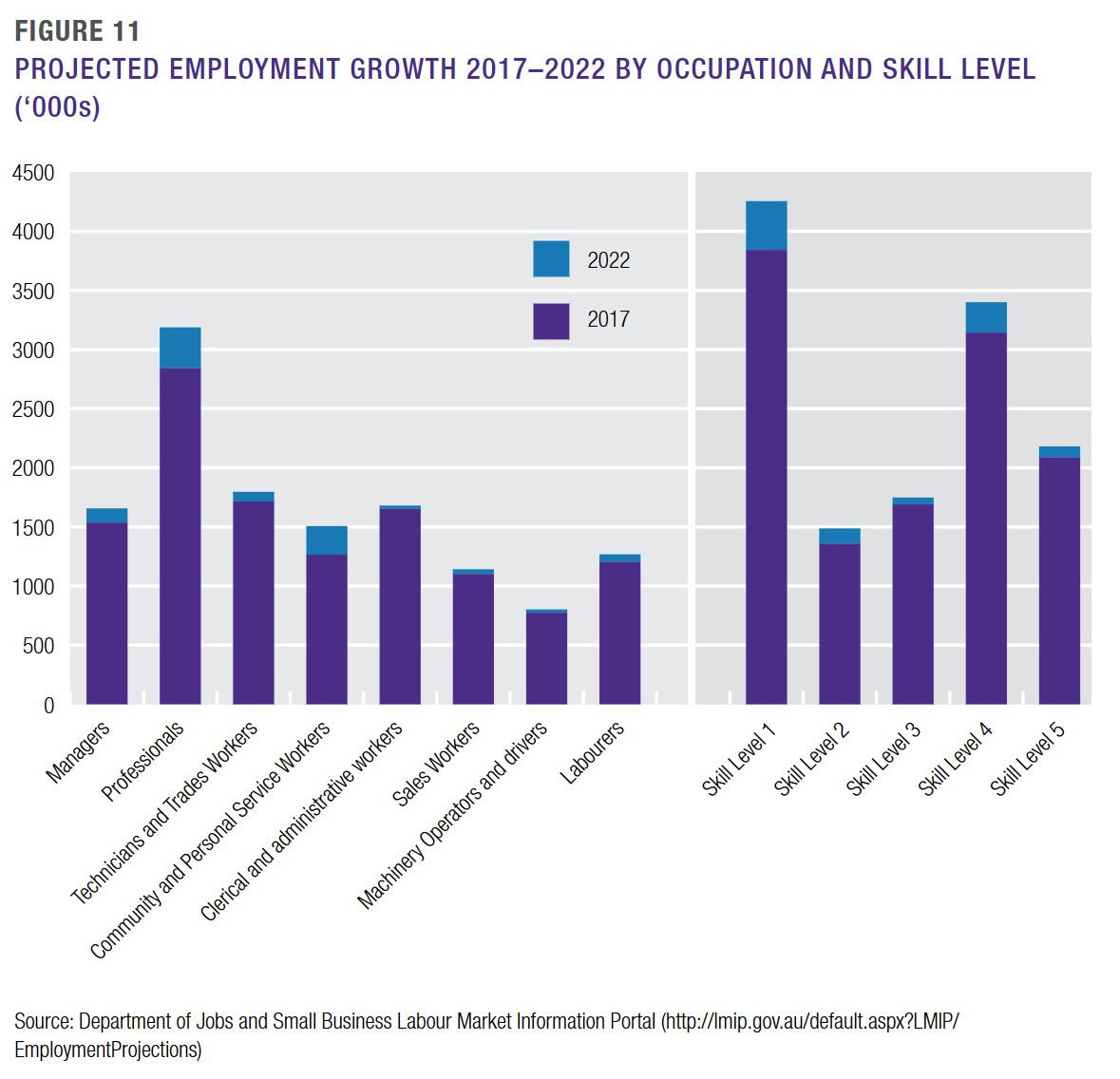

The report highlights workforce disadvantage is also evident for people with a disability, people with mental health conditions, disadvantaged youth and Indigenous Australians.

CEDA Chief Executive, Melinda Cilento says the report reveals that measures of income inequality in Australia have not risen since the global financial crisis.

“Given our economic growth in this period, there are areas where we should have made more progress,” she said.

Housing affordability

The Australian Housing and Urban Research Institute (AHURI) weighed in on Australia’s housing affordability challenges recently, suggesting the answer could lie with planning schemes such as inclusionary zoning and density bonuses.

In their report, AHURI believe mandating the development of affordable housing when land is rezoned, offering developers voluntary planning incentives and providing density bonuses are some of the opportunities to leverage the planning system to create more affordable housing.

In earlier proposed reforms on negative gearing, AHURI suggested that the tax benefits should exclude wealthy or “sophisticated” investors in a move that could save the federal government an annual $1.7 billion without hurting “mum and dad investors”.

The Planning Institute of Australia also said affordable housing supply was a critical issue for governments – but so too is ensuring Australians have quality access to meaningful employment, good social services and facilities, and quality environments.

Chief policy officer Rolf Fenner said PIA endorsed in principle the wider use of inclusionary zoning practices, but governments could not continue to ignore the fact that the housing affordability crisis stemmed in large part from demand-side factors.

“Wholesale adoption of inclusionary zoning provisions may lead to perverse outcomes if they’re implemented without due regard to local market conditions and specific city-wide, or regional plans,” he said.

“A surer bet would be affordable housing targets developed in consultation with the community and based on quality urban design and architectural foundations.”