Sydney House Prices Skyrocketed 113% in 10 Years

Thanks to Sydney’s mighty housing boom years, the harbour city has dominated recent analysis of the nation’s biggest change in dwelling values over the past decade.

Despite a recent 5 per cent house price slump, Sydney has been far and away the top city to have owned property over the past decade.

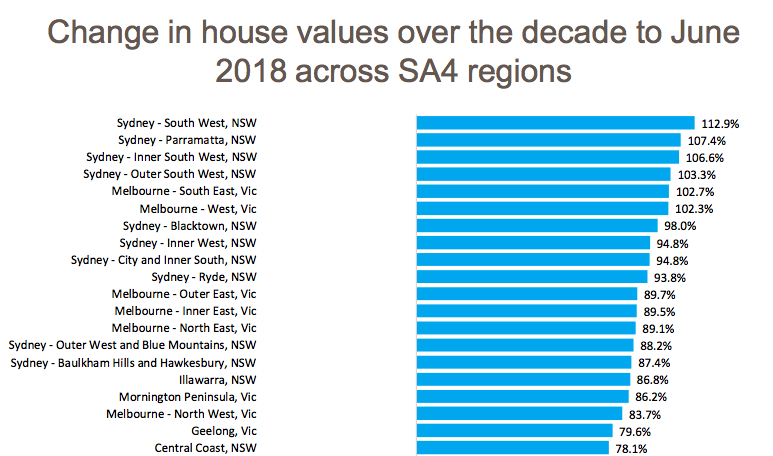

Sydney placed in the top four spots on the Corelogic Property Pulse chart, and claimed seven of the top ten places.

Corelogic analyst Cameron Kusher reveals national dwelling prices have increased by 44 per cent over the 10 years to June, with combined capital city markets recording an increase of 52.6 per cent for the same period.

Sydney’s south west region was the standout performer for the country recording the greatest increase in both housing and unit values.

Housing values grew a hefty 112.9 per cent in Sydney's south west region, and 98 per cent for units.

Related: Further Falls for Residential Property, Experts Warn

Parramatta followed in second spot experiencing an increase in value change of 107.4 per cent.

Sydney’s inner south west increased by 106.6 per cent, followed by the outer South West of Sydney at 103.3 per cent.

South east Melbourne recorded 102.7 per cent for the 10 year span, and the west region of Melbourne saw an increase of 102.3 per cent.

Kusher said value growth in NSW and Vic was substantially stronger than growth experienced anywhere else across the country.

“In fact, the regions of NSW (Riverina) and Vic (North West) that recorded the weakest conditions over the decade have seen value growth well in excess of the best performing WA region (Perth-North West),” Kusher said.

Growth in house and unit values across the past 10 years had a definite slant to strong growth in Sydney and Melbourne and weaker conditions everywhere else, explained Kusher.

“While the last 10 years is not predictive of the future, dwelling values are already falling in Sydney and Melbourne and regional markets are currently outperforming capital cities.

“With housing in a downturn in Sydney and Melbourne and affordability stretched, at this point it seems unlikely the returns of the past decade will be replicated over the next 10 years.”

Related: Sydney and Melbourne Drive Housing Price Fall

Relief for home buyers

Declining housing prices in the nation’s largest capital cities will continue to drive improvements in affordability explains Housing Industry Australia economist Diwa Hopkins, particularly in the Sydney and Melbourne markets.

The HIA Affordability Index registered 74.9 in the June quarter, up by 0.4 per cent over the quarter and up by 0.8 per cent in comparison with a year earlier when affordability had reached its poorest level in six years.

“In Sydney and Melbourne in particular, while dwelling prices are coming off the boil, rental price increases have been steady," Hopkins said.

“This suggests the overall supply of housing is well matched with demand."

“With an even balance in overall housing supply and demand in these key markets, the current downturn in dwelling prices is unlikely to be prolonged or severe."