Retail Performance Boosts REIT Revenue

Promising retail results are supporting Australian real estate investment trusts as turnover rent deals and online shopping become commonplace.

Compared to 2019 overall retail turnover is up 13.3 per cent according to the latest Australian Bureau of Statistics data.

However the shift to online shopping, retail space consolidation and turnover rent deals are making it harder to predict property companies’ revenue and cash flow, Moody’s Investor Service reports.

During the peak of national lockdowns retail property company income dropped on average by 42 per cent, however the majority of this fall was due to waivers and provisions for tenants.

Australian REIT net property income changes

| Dec 19 | June 20 | Change | Waivers | Provisions | Assistance as a percentage of NPI | |

|---|---|---|---|---|---|---|

| Vicinity | 439 | 245 | -44% | 109 | 60 | 38% |

| The GPT Group | 164 | 75 | -54% | 43 | 33 | 46% |

| Mirvac | 91 | 51 | -44% | 10 | 30 | 44% |

| Scentre | 954 | 658 | -31% | 77 | 155 | 24% |

| Stockland | 209 | 134 | -36% | 27 | 36 | 30% |

| Average | -42% | 37% |

^Source: Moody's Investor Service

Profits are expected to continue to be impacted by lockdowns, rental negotiations and online shopping however these results have improved markedly since mid-2020.

According to Moody’s the market share of online shopping, as well as working from home, has reduced the demand for retail and prime office space across the Asia Pacific, a credit negative for REITs that derive income from those spaces.

To gain control of the market, malls in Australia and other Asia Pacific countries have already launched mobile apps to expand their customer loyalty programs.

“Although the pandemic has raised the proportion of online shopping in certain Asian markets, in-person shopping will not disappear completely,” the Moody’s report said.

The retail sector in-depth report shows 63 per cent of respondents in Australia still value and look forward to in-store shopping.

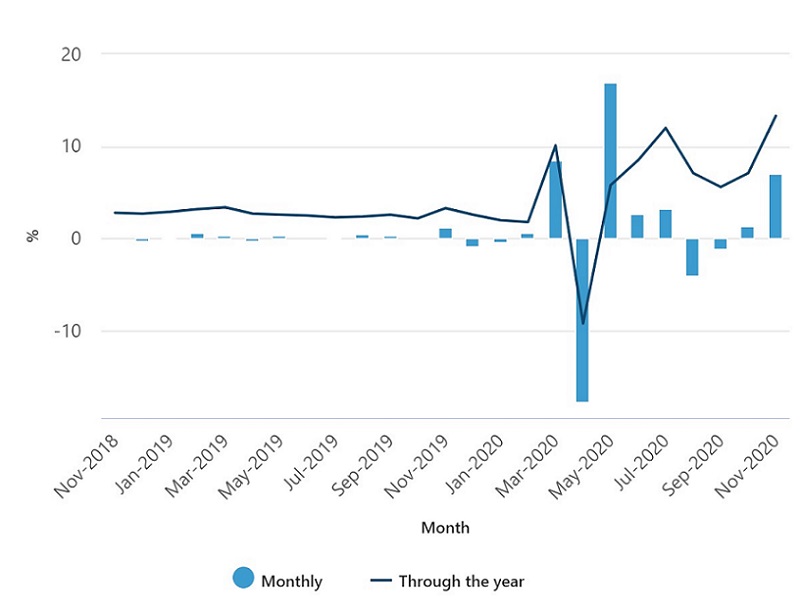

Retail turnover is on the up which should continue boost rental income in Australia following a particularly harrowing start to 2020 for retail trade and vacancies.

Total Retail Turnover

^Source: Australian Bureau of Statistics, monthly turnover seasonally adjusted

ABS data also shows the total monthly retail turnover was impacted by online sales which made up 11 per cent in in November, 10.4 per cent in October and 7.2 per cent in November 2019.

However Australian retail trade is much less affected by online shopping compared to Singapore near 11.5 per cent, US 14.5 per cent, mainland China 24.5 per cent, UK 26 per cent and Korea 43.5 per cent, according to Moody’s.