Housing Market Hangs Tough as RBA Leaves Rates Alone

The Reserve Bank of Australia at its last board meeting for the year has left interest rates right where they are.

And for the time-being at least, Australia’s housing market remains resilient to much of what the RBA has done.

Housing values rose for the 10th consecutive month in November, according to the property data information provider CoreLogic, despite interest rates rising by 1.25 per cent since the start of the year.

And in other fresh data this week, and again after 13 rate rises since May last year, the Australian Bureau of Statistics said home lending had risen 5.4 per cent in October, which made it the first year-on-year growth in new mortgage commitments in almost 18 months.

But CoreLogic Australia head of research Eliza Owen warned those figures were unlikely to continue.

“It's partly the rate hike for November,” Owen said, referring to the RBA’s decision last month to raise interest rates by 25 points to 4.35 per cent.

“And it’s partly the fact that consumer sentiment is consistently low—so that's going to weigh on transaction activity—and it's partly the fact that stock levels are now much higher across Sydney and Melbourne as well.

“So more people are selling than what we would usually see at this time of year.

“And look, part of that could be a result of high interest rates as well. If people are having issues with serviceability and needing to sell.”

“But I think it will be short-lived.”

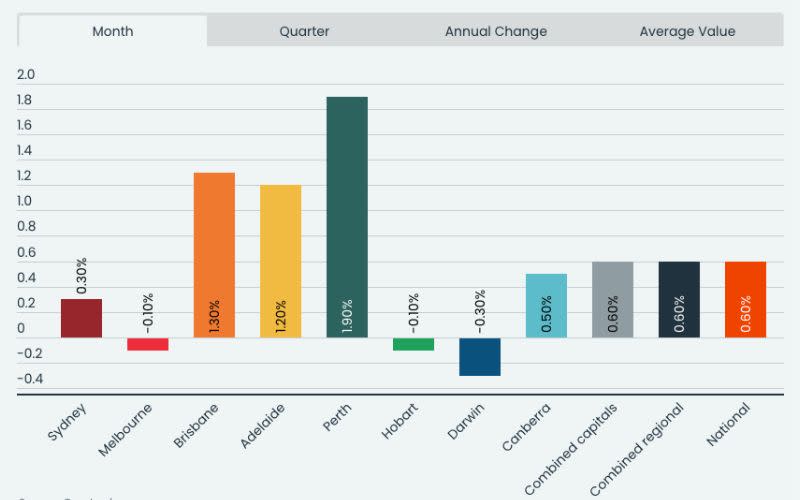

CoreLogic Home Value Index

CoreLogic’s own data for November would suggest that.

While housing values rose last month, the 0.6 per cent increase was the smallest monthly gain since the growth-cycle began in February. And the number of transactions declined 1.7 per cent.

AMP Capital chief economist Shane Oliver said the housing market’s resilience had surprised many this year.

“It certainly surprised me,” he said. “I thought prices would fall by up to 10 per cent, but in the event from February onwards, they turned around and rebounded.

“I think what’s happened here is similar to the overall explanation for the property market generally, and that is the supply shortfall in the face of surging immigration levels seems to have dominated the dampening impact of higher interest rates.”

Oliver warned there is an ongoing risk of further interest rate increases next year.

“The Reserve Bank will almost certainly retain a tightening bias or signal that if they're going to do anything, they're going to raise rates and not cut them,” he said.

The RBA’s next board of governor’s meeting is not until February.

With no meeting in January, the board will be looking at two rounds of jobs and retail sales figures as well as the December quarterly inflation figures.

“There's going to be a lot of focus on that February meeting, I suspect,” Oliver said.

“We would put the risk of another rate rise at around 40 per cent, but I think the more likely scenario is ultimately rates will be put on hold. We've reached the peak.”

While keeping its options open the RBA would not rule out further increases.

In a statement released after Tuesday’s meeting, Reserve Bank governor Michele Bullock said the impact of more recent rate rises, including that of last month, would continue to flow through the economy.

“Holding the cash rate steady at this meeting will allow time to assess the impact of the increases in interest rates on demand, inflation and the labour market,” Bullock said.

“Whether further tightening of monetary policy is required to ensure that inflation returns to target in a reasonable timeframe will depend upon the data and the evolving assessment of risks.

“In making its decisions, the board will continue to pay close attention to developments in the global economy, trends in domestic demand, and the outlook for inflation and the labour market.”