House Prices Continue to Drop, But Pace of Declines Eases

Sydney house prices—long the most expensive in the country—have recorded their steepest annual fall on record, but fresh data shows the rate of house price decline nationally is finally easing.

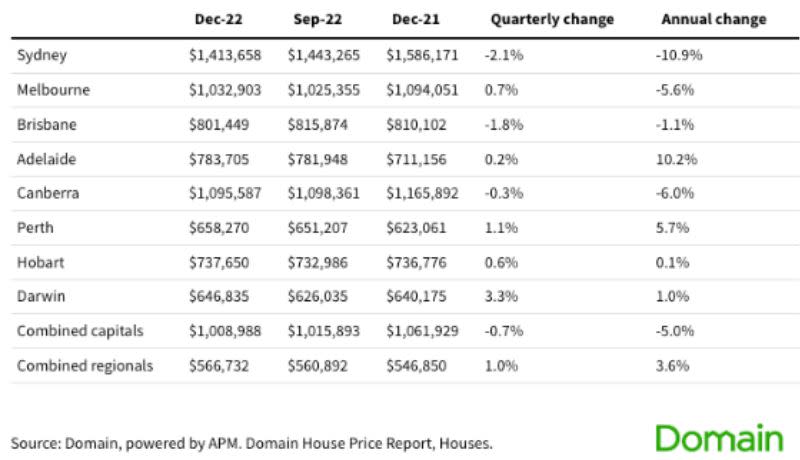

Australia-wide, Domain Group’s house price report revealed the median house prices across the nation’s capital cities have declined 0.7 per cent—or six times slower—from the previous September quarter. Unit prices declined three times more slowly.

Still, Sydney led declines with house prices falling 2.1 per cent for the quarter and 10.9 per cent over the past 12 months. Median house prices in Australia’s most populous city fell around $170,000 to $1,413,658 last year.

Melbourne’s median house price was $1,032,903 in the December quarter, which was actually 0.7 per cent higher than the previous three months. The city’s annual fall of 5.6 per cent was the steepest for more than three years.

The housing industry is likely to take heart from the Domain report.

“The data suggests that the peak rate of the quarterly decline has passed as buyers have had time to adjust to the new norm of rising debt cost and reduced borrowing capacity,” said Domain’s chief of research and economics, Dr Nicola Powell.

“Based on calculations from Domain Home Loans, those with a $1 million mortgage are now paying almost $1800 more on their loan than this time last year which has been a hard pill to swallow,” Powell said.

The house price data was followed by an Australian Bureau of Statistics release showing annual inflation was at 7.8 per cent, less than the Reserve Bank’s forecast that inflation would peak at eight per cent over the year.

The figures show quarterly headline inflation was 1.9 per cent for December, an increase from 1.8 per cent in the September quarter.

That’s likely to ease pressure on the RBA to push interest rates higher to combat inflation, when the Board of Governors meets on February 7.

Powell said the spring selling season bore the brunt of interest rate shocks and sky-high inflation levels.

“This is why the September quarter saw house prices fall at their fastest quarterly rate,” she said.

“Sellers have been sitting on the sidelines to see how the housing market downturn unravelled and how high inflation and interest rates would land.”

Brisbane’s housing market slowdown lost momentum with house prices falling at less than half the pace of the previous quarter. House prices are now 6.6 per cent below their June 2022 peak, down by about $56,000 but still 34.4 per cent higher than in March 2020.

Adelaide set a record high with house prices up 10.2 per cent for the year, although the pace of growth continues to lose steam with quarterly price growth the slowest since prices declined mid-2020.

Perth remains one of the country’s strongest housing markets—joining Adelaide as one of two cities to set a record for house prices. The upswing continues to ease as quarterly house price growth has been slow.

Hobart house prices appear to have stabilised, remaining just 3.8 per cent below the March 2022 peak. However, housing prices in the Tasmanian capital are a staggering 46.4 per cent higher than before the pandemic property boom.

Apartment prices are likely to remain firm, according to Powell.

“The property price falls and the state and federal government support schemes for affordability-challenged buyers, such as the NSW Government First Home Choice Scheme, is going to bring first-home buyers front and centre this year,” she said.

“For this reason, we’ll likely find that unit prices will hold firmer for market entrants as affordability constraints, reduced borrowing capacity, an extremely tight rental market and migration returning will continue to support demand.”

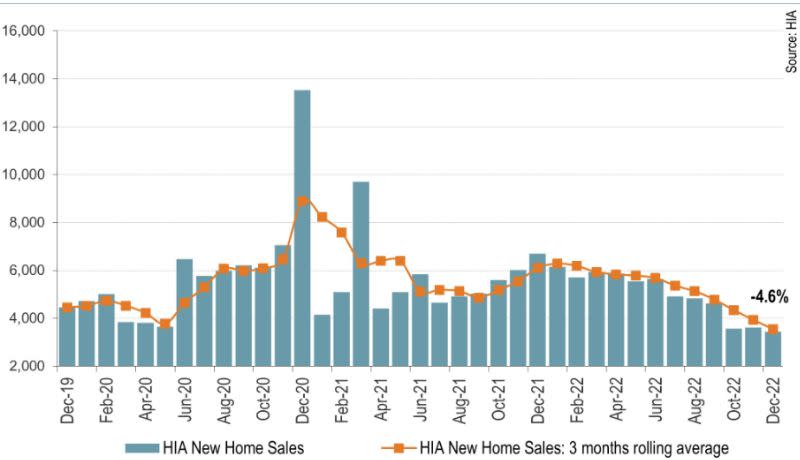

That view was supported by new research, also released this week, by the Housing Industry of Australia, which showed the decline in new home sales is accelerating.

The HIA’s new home sales report—a monthly survey of the biggest volume home builders in the five biggest states—said new home sales fell 42 per cent in the past year.

That decline continues, according to HIA chief economist Tim Reardon, with new home sales down 4.6 per cent in December.

“This slowing in sales will flow though to a slowdown in building activity in the second half of 2023,” Reardon said.

“When this hiking cycle began, there was a significant pipeline of home building work under construction, and many more projects yet to even begin construction. This has created a significant lag in the RBA’s impact on employment across the economy.

“The rise in the cash rate has also seen many recent buyers of new homes unable to finance their new project.

“With one in five customers cancelling their new home building project each month, the pipeline of building work will be eroded quickly.”