Commercial Property Sentiment Drops to Two Year Low: NAB

Overall sentiment in commercial property markets fell nine points to a two-year-low in the third quarter, according to the NAB Commercial Property Index.

Sentiment fell in all sectors, except CBD hotels which continues to benefit from the nation’s booming international tourism.

Bolstered by the surging demand in e-commerce, particularly concentrated along the eastern seaboard, industrial property was the next best performer, according to the survey which covers 300 property professional respondents.

NAB Group chief economist Alan Oster said the overall two-year low in sentiment was not unexpected.

“The fall was consistent with weaker business conditions also seen in NAB’s September Quarter Business Survey,” Oster said.

Looking ahead, confidence in the commercial property sector over the next two-year period has also fallen, with the outlook in retail especially low.

Related: Property Market Confidence ‘Collapsing’: Survey

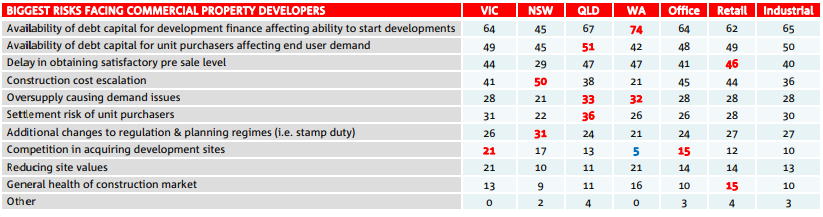

Top risks faced by commercial property developers

Property professionals operating in commercial property markets identified the risks faced by commercial property developers in the next year.

The biggest risk according to six in 10 (59 per cent) was the availability of debt capital for development finance to start new projects.

The next issue was the availability of debt capital for unit buyers affecting end user demand (46 per cent), delays in obtaining satisfactory pre-sale levels (41 per cent) and rising construction costs (40 per cent).

Availability of debt capital to start new developments was a much bigger issue in WA (74 per cent), while accessing capital for unit purchasers was bigger in QLD (51 per cent).

Related: The Sydney and Melbourne Suburbs Likely to Underperform: Report

Developer pipeline

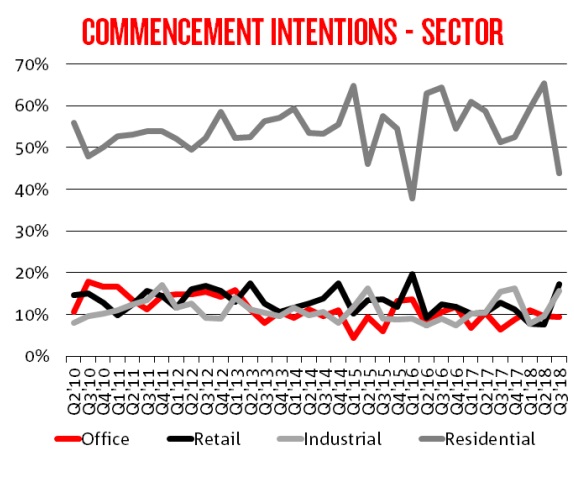

The number of property developers expecting to begin new works in the next month increased to 11 per cent, up from a survey low four per cent in the second quarter.

Overall, 42 per cent of property developers were planning to start new projects in the next six months, this figure well below survey average levels of 50 per cent, with factors adding to softer development starts including weakening house prices, over-supply of apartments and difficult funding conditions.

The number of property developers who said they were planning to commence new projects and targeting residential development projects fell to a survey low 44 per cent in the third quarter, below long-term average levels of 55 per cent.

Latest ABS data also shows that approvals for new dwellings dropped to their lowest level in two years in August, with apartment approvals falling the hardest.