Approvals Slip as Supply Push Falters Under Housing Accord

Australia’s housing pipeline took a hit in July as approvals fell after two months of growth.

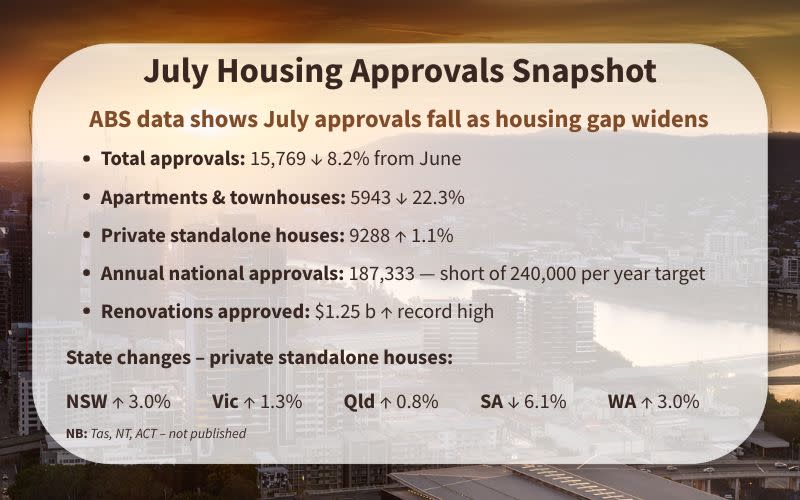

Fresh figures from the Australian Bureau of Statistics (ABS) show total home approvals fell 8.2 per cent to 15,769, seasonally adjusted.

The decline puts fresh pressure on federal and state governments aiming to deliver 1.2 million new homes by 2029 under the National Housing Accord.

ABS head of construction statistics Daniel Rossi said the fall was driven by a sharp drop in higher-density projects.

“The drop in total dwellings was driven by a 22.3 per cent fall in private dwellings excluding houses, which rose 33.5 per cent in the previous month,” Rossi said.

Approvals for private standalone houses rose 1.1 per cent nationally, led by New South Wales and Western Australia, both of which lifted 3 per cent.

Victoria posted a fourth consecutive monthly gain, up 1.3 per cent, while South Australia was the only state to fall, down 6.1 per cent.

The total value of new housing projects approved fell 2.1 per cent to $8.18 billion.

Non-residential approvals dropped 14.9 per cent to $6.09 billion, while renovation work climbed 1.9 per cent to a record $1.25 billion for the month.

Despite the monthly drop, annualised figures continue to trail federal targets.

Just 187,333 new homes were approved nationally in the 12 months to July—below the 240,000 completions required each year to meet the five-year Accord goal.

Master Builders Australia (MBA) chief economist Shane Garrett said the July results showed the appetite for new housing was there, but progress remained “uneven and too slow” to meet the scale of the Accord.

“We’re likely to have suffered a 60,000-home shortfall during the Housing Accord’s first year so we need to average 255,000 homes annually over the remaining four years of the Accord,” he said.

“The pace of building approvals over the past 12 months is more than 66,000 below this speed requirement. If it stays like this, we’re in for a 265,000 deficit against the Accord’s 1.2 million target.”

NSW recorded its lowest annualised approvals for standalone houses in a decade.

Across all housing types, the state approved 50,220 new homes in the 12 months to July, according to the ABS.

Urban Taskforce acting chief executive Stephen Fenn said the result marked an improvement on last year but remained well short of what was needed.

“To put the approvals figures in context, NSW needs approximately 77,000 new homes each year for five years. We are nowhere near that at present,” Fenn said.

He also flagged the flatlining of detached approvals as a critical concern for greenfield supply.

“This requires greater investment in housing-enabling infrastructure—water and roads—and commitment to easing the burden of fees, taxes and charges on new housing,” he said.

“The clock is ticking—the Commonwealth and the states need to work collaboratively to deliver a full suite of reforms and infrastructure funding packages that will ensure infill and greenfield housing supply grows and meets demand.”

The figures were released the day the NSW government launched a tender for an artificial intelligence tool to accelerate the assessment of State Significant Development applications.

“AI could become a game-changer when it comes to much of the ‘grunt work’ involved in assessing applications,” Fenn said.

Property Council of Australia group executive Matthew Kandelaars said the July figures were a disappointing setback as governments attempt to lift supply.

“It is heartening to see a concerted effort across the country to hit our housing targets, but today’s data shows that increased approvals across a single month or two won’t be enough,” Kandelaars said.

“Progress is being made but the supply pipeline remains constrained, as these numbers show.”

Kandelaars pointed to construction costs, labour shortages, complex approvals, taxes and low on-site productivity as persistent barriers to delivery.

“We must also ensure all housing types are counted towards our 1.2 million new homes target,” he said.

MBA chief executive Denita Wawn said the figures highlighted both positive signs and the challenges ahead.

“Builders are encouraged by the steady lift in detached home approvals and the strongest quarterly performance in nearly three years,” she said.

“But the slump in higher-density approvals is a real concern because that is where the Accord will rely most heavily for delivery.

“Australians need more homes, and approvals are a critical leading indicator of future supply. Demand is there, but unless governments make it easier to get projects approved and more workers into the industry, that demand will remain unrealised.”

Oxford Economics head of forecasting Timothy Hibbert said the July decline reflected a normalisation after June’s spike, but broader momentum was building.

He expects commencements to approach 200,000 by 2026, supported by structural reform.

“The accumulation of rezoning, planning concessions, institutional investment incentives and social housing renewal will play a defining role,” Hibbert said.